To calculate your company’s debt-to-equity ratio you’ll need your company’s total liabilities and shareholders’ equity. The optimal debt-to-equity ratio will tend to vary widely by industry, but the general consensus is that it should not be above a level of 2.0. While some very large companies in fixed asset-heavy industries (such as mining or manufacturing) may have ratios higher than 2, these are the exception rather than the rule. The D/E ratio does not account for inflation, or moreover, inflation does not affect this equation.

- Analysts and investors compare the current assets of a company to its current liabilities.

- Although debt financing is generally a cheaper way to finance a company’s operations, there comes a tipping point where equity financing becomes a cheaper and more attractive option.

- The D/E ratio includes all liabilities except for a company’s current operating liabilities, such as accounts payable, deferred revenue, and accrued liabilities.

- If a company has a negative D/E ratio, this means that it has negative shareholder equity.

Role of Debt-to-Equity Ratio in Company Profitability

It suggests that a company relies heavily on borrowing to fund its operations, often due to insufficient internal finances. Essentially, the company is leveraging debt financing because its available capital is inadequate. A decrease in the D/E ratio indicates that a company is becoming less leveraged and is using less debt to finance its operations. This usually signifies that a company is in good financial health and is generating enough cash flow to cover its debts. The debt-to-equity ratio is one of several metrics that investors can use to evaluate individual stocks.

Debt to Asset Ratio: How to Calculate, Formula & More

This looks at the total liabilities of a company in comparison to its total assets. On the surface, this may sound like the debt ratio formula is the same as the debt-to-equity ratio formula. However, the total debt ratio formula includes short-term assets and liabilities as part of the equation, which the debt-to-equity ratio discounts. Also, this ratio looks specifically at how much of a company’s assets are financed with debt. When using a real-world debt to equity ratio formula, you’ll probably be able to find figures for both total liabilities and shareholder equity on a company’s balance sheet.

Why Debt Capital Matters

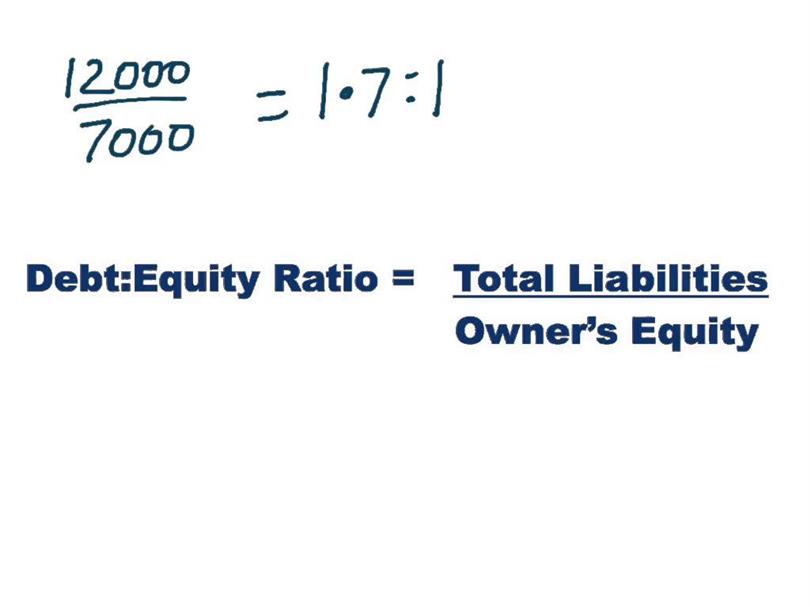

This ratio helps indicate whether a company has the ability to make interest payments on its debt, dividing earnings before interest and taxes (EBIT) by total interest. Most of the information needed to calculate these ratios appears on a company’s balance sheet, save for EBIT, which appears on its profit and loss statement. To look at a simple example of a debt to equity formula, consider a company with total liabilities worth $100 million dollars and equity worth $85 million. Divide $100 million by $85 million and you’ll see that the company’s debt-to-equity ratio would be about 1.18.

Part 2: Your Current Nest Egg

The cost of debt and a company’s ability to service it can vary with market conditions. As a result, borrowing that seemed prudent at first can prove unprofitable later under different circumstances. A higher debt to asset ratio suggests greater financial risk, as more assets are financed by debt, increasing interest obligations and potential effective tax rate definition insolvency risk during downturns. The debt to asset ratio is used to assess the proportion of a company’s assets financed through debt, indicating its leverage and financial risk. A ratio above 50% suggests that more than half of the company’s assets are financed by debt, indicating potentially high leverage and financial risk.

Debt to Equity (D/E) Ratio Calculator

However, the treatment of retained earnings in the calculation of the debt-to-equity ratio is consistent under both IFRS and US GAAP. If a company has a D/E ratio of 5, but the industry average is 7, this may not be an indicator of poor corporate management or economic risk. There also are many other metrics used in corporate accounting and financial analysis used as indicators of financial health that should be studied alongside the D/E ratio. A company’s management will, therefore, try to aim for a debt load that is compatible with a favorable D/E ratio in order to function without worrying about defaulting on its bonds or loans. The debt-to-equity ratio is primarily used by companies to determine its riskiness.

As implied by its name, total debt is the combination of both short-term and long-term debt. Assessing whether a D/E ratio is too high or low means viewing it in context, such as comparing to competitors, looking at industry averages, and analyzing cash flow. The D/E ratio indicates how reliant a company is on debt to finance its operations. And, when analyzing a company’s debt, you would also want to consider how mature the debt is as well as cash flow relative to interest payment expenses. It’s also important to note that interest rate trends over time affect borrowing decisions, as low rates make debt financing more attractive. Put another way, if a company was liquidated and all of its debts were paid off, the remaining cash would be the total shareholders’ equity.

As noted above, it’s also important to know which type of liabilities you’re concerned about — longer-term debt vs. short-term debt — so that you plug the right numbers into the formula. A company’s ability to cover its long-term obligations is more uncertain, and is subject to a variety of factors including interest rates (more on that below). For example, a prospective mortgage borrower is more likely to be able to continue making payments during a period of extended unemployment if they have more assets than debt. This is also true for an individual applying for a small business loan or a line of credit. Industries like utilities and telecommunications often have higher debt-to-asset ratios due to capital-intensive operations, while sectors such as technology may exhibit lower ratios. The higher the number, the greater the reliance a company has on debt to fund growth.

Ultimately, the D/E ratio tells us about the company’s approach to balancing risk and reward. A company with a high ratio is taking on more risk for potentially higher rewards. In contrast, a company with a low ratio is more conservative, which might be more suitable for its industry or stage of development. Considering the company’s context and specific circumstances when interpreting this ratio is essential, which brings us to the next question. Sectors requiring heavy capital investment, such as industrials and utilities, generally have higher D/E ratios than service-based industries.

You can calculate the D/E ratio of any publicly traded company by using just two numbers, which are located on the business’s 10-K filing. However, it’s important to look at the larger picture to understand what this number means for the business. It’s clear that Restoration Hardware relies on debt to fund its operations to a much greater extent than Ethan Allen, though this is not necessarily a bad thing.

A long-term debt-to-equity ratio is a ratio that expresses the relationship between a company’s long-term debts and its equity. The debt-to-equity ratio is a financial ratio most often used by bankers and investors to tell how well a company uses debt to finance its operations. It is an important calculation for gauging business health and how attractive your company is to banks and investors. A low debt-to-equity ratio does not necessarily indicate that a company is not taking advantage of the increased profits that financial leverage can bring.