Therefore, the overarching limitation is that ratio is not a one-and-done metric. The D/E ratio contains some ambiguity because a healthy D/E ratio often falls within a range. It may not always be clear to an investor whether the D/E ratio is, in fact, too high or low. This means that for every dollar in equity, the firm has 76 cents in debt.

Debt to Equity (D/E) Ratio Calculator

For example, manufacturing companies tend to have a ratio in the range of 2–5. This is because the industry is capital-intensive, requiring a lot of debt financing to run. When interpreting the D/E ratio, you always need to put it in context by examining 4 factors influencing local government financial decisions the ratios of competitors and assessing a company’s cash flow trends. Restoration Hardware’s cash flow from operating activities has consistently grown over the past three years, suggesting the debt is being put to work and is driving results.

Debt to Equity (D/E) Ratio:

It’s easy to get started when you open an investment account with SoFi Invest. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here). Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

What Does a Company’s Debt-to-Equity Ratio Say About It?

By contrast, higher D/E ratios imply the company’s operations depend more on debt capital – which means creditors have greater claims on the assets of the company in a liquidation scenario. Lenders and debt investors prefer lower D/E ratios as that implies there is less reliance on debt financing to fund operations – i.e. working capital requirements such as the purchase of inventory. A D/E ratio of about 1.0 to 2.0 is considered good, depending on other factors like the industry the company is in. But a D/E ratio above 2.0 — i.e., more than $2 of debt for every dollar of equity — could be a red flag. Again, context is everything and the D/E ratio is only one indicator of a company’s health. Many startups make high use of leverage to grow, and even plan to use the proceeds of an initial public offering, or IPO, to pay down their debt.

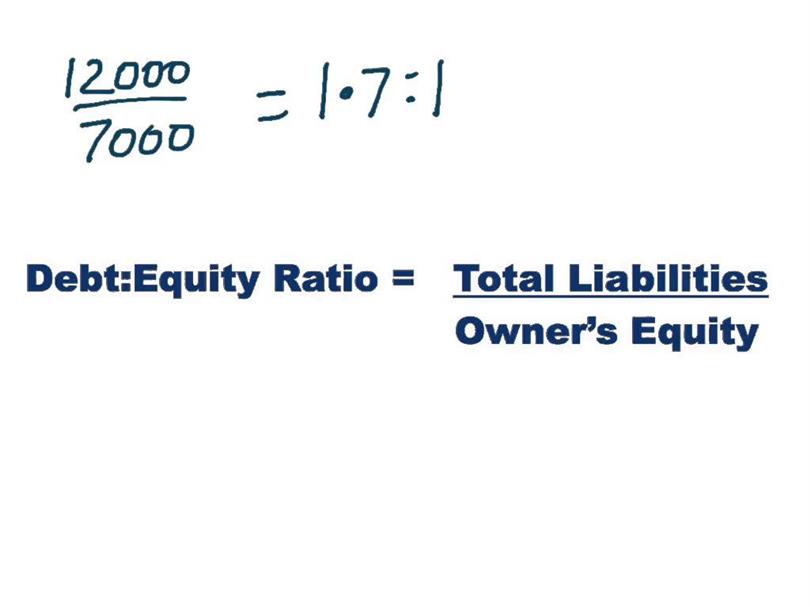

This calculation gives you the proportion of how much debt the company is using to finance its business operations compared to how much equity is being used. If the company were to use equity financing, it would need to sell 100 shares of stock at $10 each. In our debt-to-equity ratio (D/E) modeling exercise, we’ll forecast a hypothetical company’s balance sheet for five years. Investors can use the debt-to-equity ratio to help determine potential risk before they buy a stock. As an individual investor you may choose to take an active or passive approach to investing and building a nest egg. The approach investors choose may depend on their goals and personal preferences.

Get in Touch With a Financial Advisor

- Some investors also like to compare a company’s D/E ratio to the total D/E of the S&P 500, which was approximately 1.58 in late 2020 (1).

- The D/E ratio is much more meaningful when examined in context alongside other factors.

- Ultimately, businesses must strike an appropriate balance within their industry between financing with debt and financing with equity.

- They do so because they consider this kind of debt to be riskier than short-term debt, which must be repaid in one year or less and is often less expensive than long-term debt.

- The quick ratio is also a more conservative estimate of how liquid a company is and is considered to be a true indicator of short-term cash capabilities.

A debt-to-equity ratio of 0.5 means a company relies twice as much on equity to drive growth than it does on debt, and that investors, therefore, own two-thirds of the company’s assets. A debt-to-equity ratio of 2 means a company relies twice as much on debt to drive growth than it does on equity, and that creditors, therefore, own two-thirds of the company’s assets. A debt-to-equity ratio of 1 means a company has a perfect balance between its debt and equity, and that creditors and investors own equal parts of the company’s assets. A debt-to-equity ratio of between 1 and 1.5 is good for most businesses, but some industries are capital intensive and businesses in these industries traditionally take on more debt.

Investors may become dissatisfied with the lack of investment or they may demand a share of that cash in the form of dividend payments. If a D/E ratio becomes negative, a company may have no choice but to file for bankruptcy. They may note that the company has a high D/E ratio and conclude that the risk is too high. For this reason, it’s important to understand the norms for the industries you’re looking to invest in, and, as above, dig into the larger context when assessing the D/E ratio.

The debt-to-equity ratio (D/E) is one of many financial metrics that helps investors determine potential risks when looking to invest in certain stocks. The debt-to-equity ratio is most useful when used to compare direct competitors. If a company’s D/E ratio significantly exceeds those of others in its industry, then its stock could be more risky. Gearing ratios constitute a broad category of financial ratios, of which the D/E ratio is the best known. Business owners use a variety of software to track D/E ratios and other financial metrics. Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as the D/E ratio and the debt ratio.